Business Cycle: Understanding Economic Fluctuations and Their Impact

Understand the business cycle

The business cycle refer to the natural fluctuations in economic activity experience by an economy over time. These cyclical patterns involve periods of expansion follow by contraction, with vary degrees of intensity and duration. Quite than move in a straight line, economies tend to follow wave like patterns that reflect change conditions in production, employment, income, and spending.

These economic fluctuations affect almost every aspect of business operations and personal financial planning. From corporate investment decisions to government policy formulation, understand the business cycle provide crucial context for economidecision-makingng.

The four phases of the business cycle

Economists typically divide the business cycle into four distinct phases, each with unique characteristics and implications:

Expansion

During the expansion phase, the economy experience robust growth. Key indicators during this period include:

- Rise gross domestic product (gGDP)

- Decline unemployment rates

- Increase consumer confidence and spending

- Business investment growth

- Rise stock market valuations

Expansions typically last yearn than contractions in modern economies. During this phase, businesses oftentimes expand operations, hire more workers, and increase production to meet grow demand. Consumers broadly feel more confident about their financial futures, lead to higher spending and borrowing.

Peak

The peak represent the highest point of economic activity before a downturn begin. At this stage:

- The economy operate at or near full capacity

- Unemployment reach its lowest levels

- Inflation pressures frequently build

- Asset prices may reach unsustainable levels

- Interest rates typically rise as central banks attempt to control inflation

The peak phase oftentimes feature signs of economic imbalances that finally trigger the subsequent contraction. These might include excessive debt levels, asset bubbles, or unsustainable business practices that become apparent as economic conditions change.

Contraction

Likewise, know as recession, the contraction phaseinvolvese a general decline in economic activity. During contractions:

- GDP growth turn negative for two or more consecutive quarters

- Unemployment rise as businesses reduce workforce

- Consumer spending decrease

- Business investment fall

- Stock markets typically decline

- Credit conditions tighten

Contractions force businesses to reassess their operations, cut costs, and sometimes restructure wholly. Consumers typically reduce discretionary spending and focus on essential needs. Government and central bank policies oftentimes shift toward stimulate economic activity through lower interest rates or increase spending.

Trough

The trough mark the lowest point of economic activity before recovery begin. Characteristics include:

- High unemployment rates

- Low capacity utilization in industries

- Weak consumer and business confidence

- Reduced inflation or yet deflation

- Accommodative monetary policy

The trough phase finally transition to expansion as economic fundamentals improve, oftentimes aid by policy interventions, reduced costs, inventory rebuilding, and renew consumer confidence.

Measure the business cycle

Economists use various indicators to identify where an economy stand within the business cycle:

Lead indicators

These metrics typically change before the overall economy shifts direction, provide early signals of upcoming changes:

- Stock market performance

- Building permits and housing starts

- New orders for capital goods

- Consumer expectations

- Interest rate spread

- Weekly unemployment insurance claim

Coincident indicators

These indicators change roughly in tandem with the overall economy:

- GDP

- Employment levels

- Industrial production

- Personal income

- Manufacturing and trade sales

Lagging indicators

These metrics typically change after the economy has already shifted direction:

- Unemployment rate

- Consumer price index (inflation )

- Average duration of unemployment

- Business lending activity

- Labor cost per unit of output

By monitor these different types of indicators, economists, policymakers, and business leaders can substantially understand current economic conditions and make more informed predictions about future developments.

Causes of business cycles

Multiple theories attempt to explain why economies experience cyclical patterns preferably than steady growth. Most economists recognize that business cycles result from a complex interplay of factors:

Monetary factors

Changes in money supply and credit conditions importantly influence economic activity. Expansionary monetary policy (lower interest rates, increase money supply )typically stimulate economic growth, while contractionary policy ( (gher interest rates, reduce money supply ) )ch slowslowernomic activity.

The Austrian school of economics peculiarly emphasize how unnaturally low interest rates can lead to investment and finally trigger recessions when these investments prove unsustainable.

Innovation and technology

Joseph Schumpeter’s theory of” creative destruction ” uggest that business cycles are drive by waves of innovation. New technologies and business models disrupt exist industries, create both growth opportunities and painful adjustments.

Major technological revolutions — like the steam engine, electricity, computers, or the internet — have historically corresponded with significant economic expansions follow by periods of adjustment.

External shocks

Unexpected events can trigger or amplify business cycle phases:

- Natural disasters

- Pandemics

- Wars and geopolitical conflicts

- Sudden changes in commodity prices (peculiarly oil )

- Financial crises originate in other countries

These shocks can quickly alter business and consumer confidence, disrupt normal economic patterns and sometimes trigger recessions.

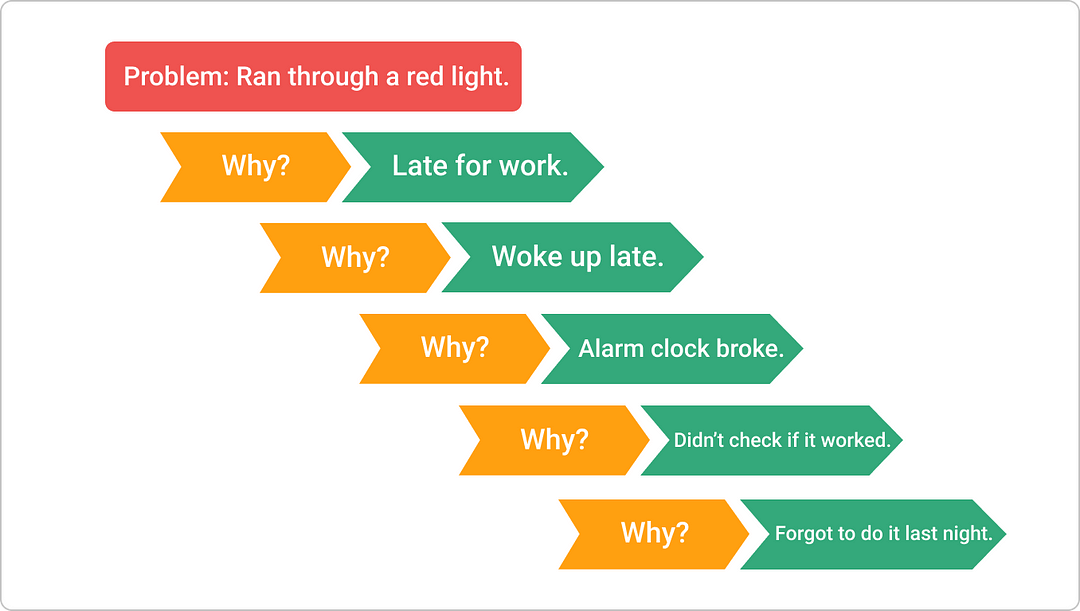

Psychological factors

Human psychology play a significant role in business cycles. During expansions, optimism can lead to excessive risk taking, overinvestment, and speculative bubbles. Conversely, pessimism during contractions can cause businesses and consumers to cut spend more than economic fundamentals might warrant, deepen recessions.

This” animal spirits ” oncept, popularize by economist joJohn Maynard Keyneshelp explain why economic fluctuations oftentimes exceed what strictly rational behavior would produce.

Policy responses to business cycles

Governments and central banks employ various tools to moderate business cycle fluctuations:

Source: ecoholics.in

Monetary policy

Central banks adjust interest rates and money supply to influence economic activity:

- During recessions, they typically lower interest rates and increase money supply to stimulate borrowing and spending

- During overheat expansions, they raise interest rates to cool inflation pressures and prevent unsustainable growth

In recent decades, central banks have besides employ unconventional monetary policies like quantitative easing (purchase financial assets to inject money into the economy )during severe downturns.

Fiscal policy

Governments use taxation and spending decisions to influence economic conditions:

- Expansionary fiscal policy (increase government spending, tax cuts )aim to stimulate economic activity during contractions

- Contractionary fiscal policy (reduce spending, tax increases )can help prevent overheat during strong expansions

Automatic stabilizers like unemployment insurance and progressive taxation to help moderate business cycles by mechanically increase government support during downturns and reduce it during expansions.

Structural policies

Beyond short term stabilization efforts, governments implement longer term policies to improve economic resilience:

- Financial regulations to prevent excessive risk taking

- Labor market reforms to improve employment flexibility

- Education and training programs to address skills mismatches

- Infrastructure investments to enhance productive capacity

These structural approaches aim to reduce the severity of business cycles by address underlie economic vulnerabilities.

Business cycle variations

While the basic four phase model provide a useful framework, actual business cycles show considerable variation:

Duration differences

Business cycles vary importantly in length. In the United States:

- Expansions have last anyplace from 10 months to over 10 years

- Contractions typically last between 6 and 18 months, though some have been longer

Modern economies have broadly experienced longer expansions and shorter contractions compare to historical patterns, partially due to improve economic management and structural changes.

Severity variations

The depth of contractions and strength of expansions to vary substantially:

- Mild recessions may involve GDP contractions of 1 2 % and moderate unemployment increases

- Severe downturns like the great depression or the 2008 financial crisis involve lots larger economic contractions and considerably higher unemployment

Likewise, expansions range from robust boom periods with strong growth across sectors to more modest recoveries with uneven benefits.

Sector specific cycles

Different economic sectors oftentimes experience their own cyclical patterns that may not utterly align with the overall business cycle:

- Housing and construction typically show pronounce cyclicality

- Consumer staples tend to be less cyclical than discretionary goods

- Technology and manufacturing oftentimes experience distinct cyclical patterns

These sector variations create both challenges and opportunities for businesses and investors seek to navigate economic fluctuations.

Source: businessyield.com

Business strategies across the cycle

Successful businesses develop strategies tailor to different phases of the business cycle:

During expansion

Expansion phases offer growth opportunities but require careful management:

- Strategic investments in capacity, technology, and market share

- Talent acquisition and development

- Prudent debt management to avoid overextension

- Diversification to prepare for eventual downturns

The virtually successful companies use expansion periods not scarce for growth but besides to build resilience for future contractions.

During contraction

Recessions require defensive strategies but besides present opportunities:

- Cost optimization and operational efficiency improvements

- Cash conservation and liquidity management

- Strategic acquisitions of distressed assets or competitors

- Continue investment in core capabilities and innovation

Companies that maintain financial flexibility during expansions oftentimes emerge stronger from recessions by capitalize on opportunities while competitors struggle.

Investment implications

Different asset classes typically perform otherwise across business cycle phase:

Expansion phase

- Equities broadly perform substantially, particularly cyclical sectors like consumer discretionary, technology, and industrials

- Commodities oftentimes see price increases as demand grow

- Real estate typically appreciates with economic growth

- Bonds may underperform as interest rates rise

Contraction phase

- Defensive equities (utilities, consumer staples, healthcare )typically outperform

- Government bonds oftentimes perform wellspring as interest rates fall

- Gold and other safe haven assets may appreciate

- Cash provide safety but limited returns

Investors who understand business cycle dynamics can adjust their portfolios to align with change economic conditions, potentially improve risk adjust returns.

Global interconnections

In today’s interconnect global economy, business cycles oftentimes transcend national boundaries:

Synchronization trends

Increase trade, financial integration, and global supply chains have lead to greater synchronization of business cycles across countries. Major economic events in one region nowadays quickly affect others through various transmission channels:

- Trade relationships

- Financial market connections

- Multinational corporate operations

- Commodity price effects

- Confidence spillovers

Regional variations

Despite increase synchronization, important differences remain in how various countries and regions experience business cycles:

- Advanced economies typically show more moderate cycles with longer expansions

- Emerge markets frequently experience more volatile cycles

- Commodity export nations face cycles hard influence by global commodity prices

- Countries with different economic structures and policies may experience asynchronous cycles

These variations create both challenges for global economic management and opportunities for geographic diversification in business operations and investment portfolios.

The evolution of business cycles

Business cycle patterns have evolved importantly over time:

Historical trends

Anterior to modern economic management, business cycles were typically more frequent and severe. The development of central banking, financial regulations, automatic stabilizers, and improve economic understanding has broadly leaded to:

- Longer expansions

- Shorter and less severe contractions

- More effective policy responses to economic shocks

Modern challenges

Despite progress, significant challenges remain in business cycle management:

- Financial innovation create new forms of systemic risk

- Global interconnections increase vulnerability to international shocks

- High debt levels in many economies constrain policy options

- Climate change introduce new forms of economic risk

- Technological disruption accelerate structural economic changes

These evolving challenges require continued adaptation in economic policy, business strategy, and investment approaches.

Conclusion

The business cycle represent one of the virtually fundamental aspects of modern economic systems. Understand its phases, cause, and implications provide essential context for business decisions, policy formulation, and investment strategies.

While perfect prediction of economic turning points remain elusive, recognize the cyclical nature of economies help organizations and individuals prepare for change conditions. The virtually successful businesses and investors typically will adopt strategies that will account for these inevitable fluctuations instead than will assume current conditions will persist indefinitely.

As economies will continue to will evolve with technological change, globalization, and new policy approaches, the nature of business cycles will probable will continue to will transform. Notwithstanding, the fundamental pattern of expansion and contraction — drive by the complex interplay of monetary conditions, innovation, external shocks, and human psychology — remain a defining feature of market economies that merit ongoing study and adaptation.

MORE FROM ittutoria.net