Business Insurance Essentials: Complete Coverage Guide for Entrepreneurs

Understanding business insurance fundamentals

Business insurance serve as a critical safety net for companies of all sizes. Without adequate coverage, yet minor incidents can threaten your company’s financial stability and future operations. This comprehensive guide will help you understand what insurance your business needs and what these policies typically will cover.

Essential business insurance types

General liability insurance

General liability insurance is the foundation of business protection. This coverage shield your business from financial losses relate to bodily injury, property damage, and advertising injury claims.

Key protections include:

- Customer injuries on your premises

- Damage to client property

- Product liability claim

- Advertising mistakes (like copyright infringement )

- Legal defense costs

Almost every business need general liability insurance. Whether you operate a retail store, provide professional services, or run an online business, this coveragprotectsct against common risks that could differently lead to significant financial losses.

Professional liability insurance

Besides know as errors and omissions (eego)insurance, professional liability coverage is essential for service base businesses. This policy protects against claims of negligence, mistakes, or failure to deliver promise services.

Businesses that should prioritize professional liability include:

- Consultants

- Financial advisors

- Healthcare providers

- It professionals

- Real estate agents

- Architects and engineers

Professional liability insurance cover legal defense costs, settlements, and judgments result from professional mistakes or omissions. Without this coverage, yet unfounded claims could drain your financial resources through legal fees solely.

Property insurance

Business property insurance protect your physical assets from perils such as fire, theft, vandalism, and certain natural disasters. This coverage applies to:

- Buildings (own or lease )

- Equipment and machinery

- Inventory and supplies

- Furniture and fixtures

- Computers and electronics

Property insurance typically covers repair or replacement costs for damage items. Many policies besides include business interruption coverage, which compensate for lost income during periods when you can not operate due to cover property damage.

Workers’ compensation insurance

Workers’ compensation insurance is mandatory in most states for businesses with employees. This coverage provides benefits to workers who suffer job relate injuries or illnesses, include:

- Medical expenses

- Lose wages

- Rehabilitation costs

- Death benefits for families

Beyond fulfil legal requirements, workers’ compensation protect your business from potential lawsuits relate to workplace injuries. Requirements vary by state, with different thresholds base on the number of employees and industry type.

Business owner’s policy (bop )

A business owner’s policy combine general liability and property insurance into a single, oftentimes more affordable package. Many bops besides include business interruption coverage as standard. This bundle approach typically cost less than purchase separate policies.

Bops are ideal for:

- Small to medium-sized businesses

- Companies with physical locations

- Businesses with valuable equipment or inventory

While a bop provide comprehensive coverage for many risks, it’s important to understand its limitations. Certain exposures, such as professional liability, auto accidents, and worker injuries, typically require separate policies.

Industry specific insurance need

Retail businesses

Retail operations face unique risks relate to customer interactions, product sales, and inventory management. Key coverages include:

- General liability (for customer injuries )

- Property insurance (for inventory and fixtures )

- Product liability (for claims relate to sell items )

- Crime insurance (for theft and fraud )

Retailers should besides consider business interruption coverage, which can be crucial during temporary closures due to property damage or other cover events.

Service base businesses

Service providers face different exposures than product base businesses. Important coverages include:

- Professional liability (for service errors )

- General liability (for third party injuries )

- Cyber liability (for data breaches )

- Commercial auto (for business vehicles )

The specific services you’ll provide will determine your exact insurance needs. For example, financial advisors may need specialized coverage for investment advice, while contractors might require builder’s risk insurance for construction projects.

Home base businesses

Don’t assume your homeowner’s policy cover your business activities. Most personal insurance policies exclude business relate claims. Home base entrepreneurs should consider:

- Home base business endorsements

- General liability coverage

- Professional liability insurance

- Business property coverage

Many insurance companies offer specialized packages for home base businesses that provide appropriate coverage at reasonable rates.

Additional coverage options to consider

Commercial auto insurance

If your business own vehicles or if employees use their personal vehicles for business purposes, commercial auto insurance is essential. Personal auto policies typically exclude business use, create potential coverage gaps.

Commercial auto insurance cover:

- Liability for accidents during business operations

- Physical damage to company vehicles

- Medical payments for injured drivers and passengers

- Uninsured / underinsured motorist protection

For employees use personal vehicles, consider non-own auto liability coverage to protect your business from claims arise from accidents during work relate driving.

Cyber liability insurance

With increase digital threats, cyber liability insurance has become essential for businesses of all sizes. This coverage help with costs relate to data breaches, hacking, ransomware, and other cyber incidents.

Cyber policies typically cover:

- Data breach notification expenses

- Credit monitoring for affected customers

- Legal fees and settlements

- Ransomware payments

- Business interruption from cyber events

- It forensics and recovery costs

Any business that collect customer information, accept online payments, or rely on computer systems should consider cyber liability insurance.

Source: artofit.org

Employment practices liability insurance (eEPL))

EPL protects against claims make by employees allege discrimination, wrongful termination, harassment, or other employment relate issues. This coverage is progressively important as workplace lawsuits continue to rise.

EPL cover legal defense costs and potential settlements relate to:

- Discrimination claim

- Sexual harassment allegations

- Wrongful termination suits

- Breach of employment contract

- Failure to promote

- Mismanagement of employee benefits

Businesses with employees should powerfully consider this coverage, as employment claims can be costly yet when the employer prevails.

Business interruption insurance

When disaster strike, the income loss during downtime can be more financially damaging than physical property damage. Business interruption insurance help replace lose income when you can’t operate due to a cover peril.

This coverage typically pays for:

- Lose profits

- Fixed operating expenses

- Temporary relocation costs

- Employee wages

- Loan payments

Business interruption insurance is oftentimes included in property policies or bops but can besides be purchase singly. Consider how yearn your business could survive without revenue when determine appropriate coverage limits.

Understand what business insurance covers

Property damage protection

Business insurance provide financial protection when your physical assets are damage or destroy. Coverage typically extends to:

- Buildings and structures

- Business equipment and machinery

- Inventory and raw materials

- Furniture and fixtures

- Computers and data

Most policies cover damage from fire, lightning, explosions, windstorms, hail, smoke, vandalism, and theft. Notwithstanding, certain perils like floods and earthquakes typically require separate policies or endorsements.

Liability protection

Liability coverage protect your business when you’re lawfully responsible for cause harm to others. This protection include:

- Third party bodily injury claims

- Property damage to others’ belongings

- Personal and advertising injury (like libel or slander )

- Legal defense costs

- Settlements and judgments

Liability insurance respond when someone sue your business, cover both the cost of defend the lawsuit and any result damages up to policy limits.

Business continuity support

Various business insurance components help ensure your company can survive unexpected interruptions:

- Business interruption coverage replaces lose income

- Extra expense coverage pay for additional costs to maintain operations

- Contingent business interruption cover losses from supplier problems

- Civil authority coverage apply when government actions prevent access to your premises

These protections will help will bridge financial gaps during recovery periods, will increase the likelihood your business will survive significant disruptions.

Determine your business insurance need

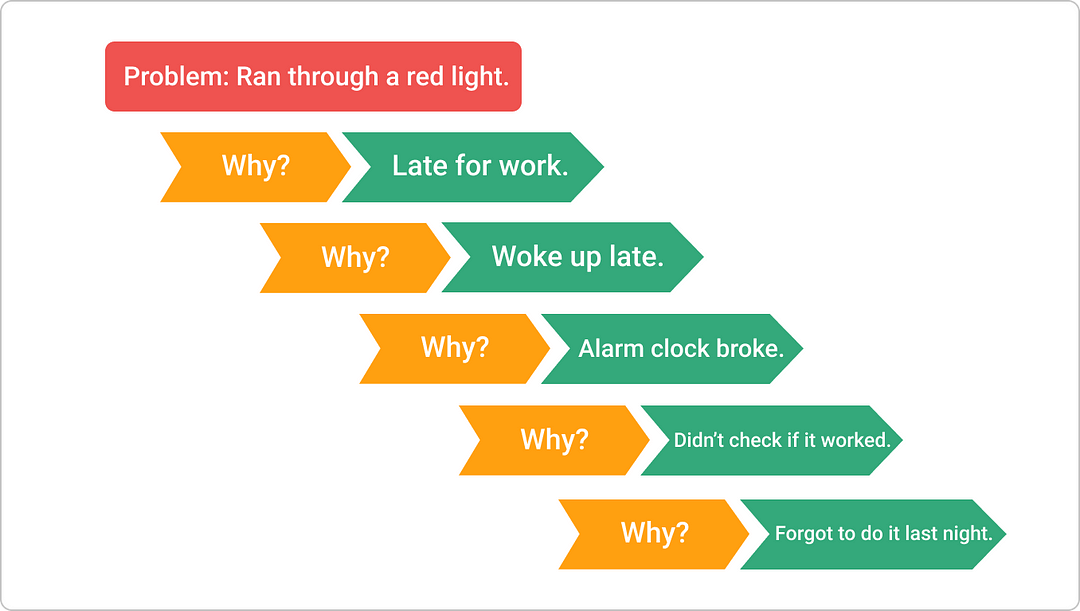

Assess your risk exposure

Start by identify the specific risks your business face. Consider:

- Industry specific hazards

- Location base risks (weather patterns, crime rates )

- Operational activities

- Number of employees

- Revenue and asset values

- Contractual requirements

A thorough risk assessment helps prioritize coverage needs and avoid both underinsurance and unnecessary policies.

Legal requirements

Several types of business insurance may be lawfully mandated depend on your location and operations:

- Workers’ compensation (require in most states for businesses with employees )

- Commercial auto insurance (for company vehicles )

- Professional liability (require in certain regulate industries )

- Surety bonds (for specific business activities )

Research your state and local requirements cautiously, as non-compliance can result in penalties, fines, or business license issues.

Contractual obligations

Beyond legal requirements, your business may need specific insurance to fulfill contractual obligations with:

- Commercial landlords (require liability and property coverage )

- Clients (much stipulate professional liability limits )

- Lenders (protect collateral with property insurance )

- Vendors and partners (require certificates of insurance )

Review all business contracts cautiously for insurance requirements, as failure to maintain require coverage could constitute breach of contract.

Find the right business insurance

Work with insurance professionals

While online research provide valuable background information, consult with insurance professionals offer several advantages:

- Independent agents represent multiple carriers and can compare options

- Industry specialists understand unique business risks

- Professionals help identify coverage gaps and redundancies

- Agents assist with claims processes when losses occur

Look for agents or brokers with experience in your specific industry who can provide tailored recommendations.

Compare policies and providers

When evaluate business insurance options, don’t focus exclusively on premiums. Consider:

- Coverage limits and exclusions

- Deductible amounts

- Claims process reputation

- Financial stability ratings (a.m. best, standard & poor’s )

- Industry specialization

- Customer service reviews

Request quote from multiple providers and compare them cautiously, ensure you’re evaluated equivalent coverage quite than but compare prices.

Cost saving strategies

Business insurance is an investment in protection, but several strategies can help manage costs:

- Bundle policies with the same insurer for multi policy discounts

- Implement risk management programs to qualify for premium reductions

- Choose higher deductibles to lower premium costs

- Pay premiums yearly alternatively of monthly when possible

- Join industry associations that offer group insurance rates

- Review coverage yearly to adjust for business changes

Remember that the cheapest policy isn’t invariably the best value. Inadequate coverage can cost far more in the long run if a significant claim exceeds your policy limits.

Review and update your coverage

Business insurance isn’t a set it and forget it purchase. As your business evolve, your insurance need change also. Schedule annual insurance reviews to assess:

- Changes in revenue or payroll

- New products or services

- Additional locations

- Equipment purchases or upgrades

- Fluctuations in inventory values

- Employee count change

Proactively update your coverage ensure you’re adequately protected as your business grow and evolves. Fail to update policies can result in coverage gaps that leave your business vulnerable exactly when protection is about need.

Conclusion

The right business insurance portfolio provide essential protection against risks that could differently threaten your company’s financial stability and future. By understand what coverage your specific business needs and what these policies protect against, you can make informed decisions that safeguard your enterprise.

Source: integratedinsuranceadvisors.com

Start with the fundamentals — general liability, property, and any lawfully require coverage like workers’ compensation. So add specialized policies base on your industry, operations, and risk exposure. Work with knowledgeable insurance professionals to develop a comprehensive protection strategy that balance adequate coverage with cost considerations.

Remember that business insurance is an investment in your company’s resilience and longevity. The right coverage provide not equitable financial protection but besides peace of mind, allow you to focus on grow your business with confidence that you’re prepared for the unexpected.

MORE FROM ittutoria.net