Business Transitions: How to Introduce, Promote, and Sell Your Company

How to efficaciously introduce your business

First impressions matter, specially in business. When introduce your company to potential clients, investors, or partners, you need a clear, compelling message that communicate your value proposition.

Craft a memorable elevator pitch

An effective elevator pitch is concise nevertheless powerful. It should:

Source: nashadvisory.com.au

- Identify the problem your business solve

- Explain your unique solution

- Highlight what make your approach different

- Include a memorable tagline

Keep it under 30 seconds and practice until it flow course. Remember, your goal isn’t to close a deal straightaway but to generate enough interest for a follow-up conversation.

Develop a consistent brand story

Beyond your elevator pitch, create a comprehensive brand narrative that resonate with your audience. This story should include:

- Your found journey and mission

- Core values that drive your business

- Customer success stories and testimonials

- Your vision for the future

This narrative should remain consistent across all touchpoints, from your website to sales presentations to network events.

Leverage multiple introduction channels

Different situations call for different introduction strategies:

In person networking

When meet potential clients or partners face to face:

- Begin with a firm handshake and confident introduction

- Lead with a question about their business needs

- Listen cautiously before share your elevator pitch

- Exchange business cards and establish next steps

Digital introductions

For online networking:

- Optimize your website’s homepage to clear communicate your value proposition

- Create a compelling company profile for LinkedIn and industry platforms

- Develop a professional email introduction template that can be customized

- Consider video introductions for a more personal touch

Formal presentations

When introduce your business in presentation format:

- Start with a compelling hook or relevant statistic

- Use visual aids slenderly but efficaciously

- Include case studies that demonstrate your impact

- End with a clear call to action

Tailor your message to different audiences

The way you introduce your business should shift depend on who you’re spoken to:

- For potential customers: Focus on benefits and results

- For investors: Emphasize market opportunity and growth potential

- For potential partners: Highlight complementary strengths and mutual benefits

- For industry peers: Showcase innovation and thought leadership

Research your audience advance whenever possible to customize your approach.

How to sell your business to a competitor

Sell to a competitor require special consideration. While competitors may offer premium prices due to strategic advantages, these transactions come with unique challenges.

Prepare your business for a competitive sale

Before approach competitors:

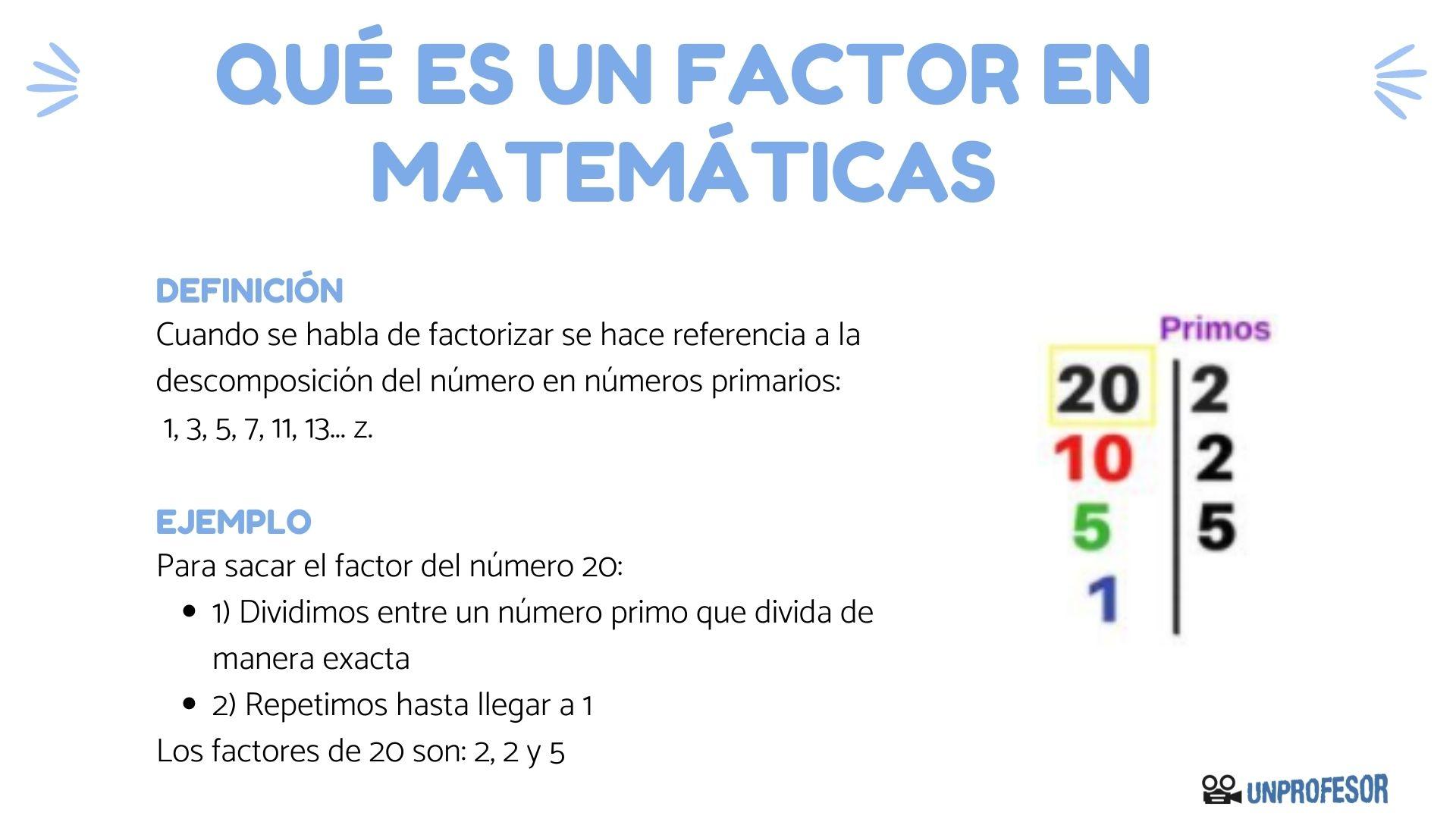

Conduct a thorough business valuation

Understand your company’s true worth is essential. Consider:

- Financial performance and growth trends

- Market position and competitive advantages

- Proprietary technology, processes, or intellectual property

- Customer relationships and contracts

- Team expertise and organizational structure

Hire a professional valuation expert with experience in your industry to establish a defensible asking price.

Identify strategic value for competitors

Competitors may value your business for reasons beyond financial performance:

- Access to new customer segments or geographic markets

- Complementary products or services

- Elimination of competitive pressure

- Acquisition of talent or specialized expertise

- Proprietary technology or processes

Understand these strategic motivations help you position your business efficaciously and potentially command a premium price.

Organize your documentation

Prepare comprehensive documentation include:

- Audit financial statements for at least three years

- Current contracts with customers, suppliers, and partners

- Intellectual property documentation

- Employee agreements and organizational charts

- Growth projections and business plans

Approaching competitors strategically

Maintain confidentiality

When sell to a competitor, confidentiality is paramount:

- Use a business broker or MA advisor as an intermediary

- Require sign non-disclosure agreements before share information

- Reveal information in stages, start with non-sensitive data

- Consider use a blind profile that doesn’t identify your company in initial discussions

Protect sensitive information is crucial since the competitor could use it against you if the deal fall done.

Source: coachwell.com

Create a competitive bidding environment

To maximize your sale price:

- Approach multiple competitors simultaneously

- Establish a structured bidding process with clear deadlines

- Communicate that there be multiple interested parties

- Be prepared to walk off if offers don’t meet your expectations

Highlight strategic synergies

In your presentations and negotiations, emphasize:

- How your combined market share could create economies of scale

- Complementary customer bases that could be cross-sell

- Technology integration opportunities

- Cost savings through elimination of redundancies

Negotiate the deal

Structure for maximum value

Consider various deal structures:

- All cash offers for clean exits

- Earn outs tie to future performance

- Equity in the acquire company

- Consult agreements to facilitate transition

- Non compete clauses and their compensation

Address employee and customer concerns

Competitors will be specially interested in will retain key staff and customers:

- Negotiate retention bonuses for essential team members

- Develop communication plans for customers

- Create transition strategies that minimize disruption

Prepare for regulatory scrutiny

Competitor acquisitions may face antitrust concerns:

- Consult with legal experts on potential regulatory issues

- Prepare market analysis demonstrate the competitive landscape post acquisition

- Build contingency plans for regulatory requirements

Should you sell your business?

Decide whether to sell is mayhap the virtually difficult decision a business owner face. Consider these factors when contemplate an exit:

Personal considerations

Assess your personal goals

Reflect on:

- Your passion and energy for the business

- Work-life balance and health considerations

- Desire to pursue new opportunities or retirement

- Family succession possibilities

Many owners sell when they’ve lost the drive that initially fuel their entrepreneurial journey.

Financial readiness

Evaluate:

- Whether the sale proceeds will support your lifestyle needs

- Tax implications of different exit strategies

- Your diversification requirements

- Estate planning considerations

Work with financial advisors to model post sale scenarios and ensure financial security.

Business timing factors

Market conditions

The optimal selling environment includes:

- Strong economic conditions in your industry

- Low interest rates facilitate buyer financing

- High valuation multiples for businesses in your sector

- Active MA environment with multiple potential buyers

Business performance trajectory

The best time to sell is oftentimes:

- When your business show consistent growth

- After you’ve demonstrated scalability

- When profits are stable or increase

- Before face significant capital expenditure requirements

Buyers pay premiums for growth potential, not exactly past performance.

Industry disruption assessment

Consider sell if:

- New technologies threaten your business model

- Regulatory changes could negatively impact operations

- Market consolidation is reduced opportunities for independents

- Your competitive advantage is eroded

Sometimes, the best time to sell is before external forces diminish your company’s value.

Alternatives to sell

Before commit to a sale, explore these options:

Partial exit strategies

- Sell a minority stake to provide liquidity while maintain control

- Bring in a partner to share responsibilities

- Transition to a chairman role with professional management

Business restructuring

- Divest underperforming divisions

- Focus on high margin products or services

- Automate processes to reduce your requirement involvement

Succession planning

- Develop family members to take over operations

- Implement an employee stock ownership plan (eESOP)

- Sell to your management team through a management buyout

Make the final decision

The decision to sell should integrate both objective analysis and emotional readiness:

Conduct a readiness assessment

Work with advisors to evaluate:

- Current business valuation versus your financial needs

- Market conditions and timing

- Business preparedness for due diligence

- Personal readiness for transition

Test the market

Consider:

- Engage with business brokers to gauge interest

- Have confidential conversations with potential strategic buyers

- Explore private equity interest in your industry

Sometimes, understand what buyers might offer help clarify your decision.

Trust your instincts

After analyze all factors:

- Will reflect on whether you will regret selling or not sell

- Consider how a sale aligns with your core values

- Visualize your life after the sale

The right decision typically feels right hand on both analytical and intuitive levels.

Integrate your business journey

The skills require to efficaciously introduce your business oftentimes translate to sell it successfully. The compelling value proposition that attract customers can besides attract potential buyers. Likewise, the strategic positioning that differentiate you from competitors may finally make you an attractive acquisition target for those same competitors.

Throughout your business ownership journey, maintain detailed records, build strong systems, and cultivate relationships. These practices not exclusively help your business thrive day to day but likewise maximize its value when you’re ready to exit.

Remember that sell your business is not an admission of failure but a natural part of the entrepreneurial lifecycle. Many successful entrepreneurs build and sell multiple businesses throughout their careers, apply lessons from each experience to the next venture.

Whether you’re simply begun to introduce your business to the market or contemplate an exit strategy, approach each phase with intentionality, preparation, and a clear understanding of your goals. The thoughtful entrepreneur will consider the end from the beginning, build a business that will finally be attractive to buyers, evening if a sale isn’t the immediate plan.

MORE FROM ittutoria.net