Verizon Business Credit Reporting: What You Need to Know

Understand Verizon business credit reporting practices

When manage a business, understand how your service providers report to credit bureaus is crucial for maintaining healthy business credit. For Verizon business customers, know whether your payment history is report to credit bureaus can help you make informed decisions about your telecommunications services.

Do Verizon business report to credit bureaus?

Verizon business typically reports account information to business credit bureaus, but their reporting practices differ from consumer accounts. Here’s what you need to know:

Business credit reporting practices

Verizon business principally reports to business credit bureaus such as dun &Bradstreett,Experiann business, andEquifaxx business. Unlike consumer accounts, which regularly report to the three major consumer credit bureaus, business accounts follow different protocols.

The company mostly report:

- Payment history for business accounts

- Significant delinquencies (typically 90 + days belated )

- Collections activities

- Account closures due to non-payment

Yet, it’s important to note that Verizon business doesn’t inevitably report every month or for every account. Their reporting tend to be more selective compare to consumer credit reporting.

Differences between business and consumer reporting

For business owners, understand the distinction between personal and business credit reporting is essential:

- Consumer accounts (personal vVerizonaccounts )typically report to exExperiantrTransUnionand eqEquifaxonsumer bureaus

- Business account report to specialized business credit bureaus

- Business credit reports don’t include the same personal information find in consumer reports

- The scoring models and factors consider are different for business credit

This separation help protect your personal credit from business activities, but it likewise means you need to monitor both types of credit individually.

When Verizon business may report to consumer credit bureaus

While Verizon business mostly focus on business credit reporting, there be circumstances when information might appear on your personal credit report:

Personal guarantees

If you sign a personal guarantee when establish your Verizon business account, you’ve created a direct link between your business obligations and personal credit. With a personal guarantee:

- You become personally liable for the business debt

- Significant delinquencies may be report to consumer credit bureaus

- Collections activities could appear on your personal credit report

Many small business owners don’t realize they have sign personal guarantees as part of standard service agreements, hence review your contract terms is advisable.

Collections and charge offs

If your Verizon business account become badly delinquent and enter collections, the collections’ agency may report the debt to consumer credit bureaus, peculiarly if:

- The account have a personal guarantee attach

- The business is a sole proprietorship (which doesn’t have legal separation from the owner )

- The collection agency pursue both business and personal avenues for recovery

These negative items can remain on your credit report for up to seven years, importantly impact your personal credit score.

How Verizon business credit reporting affect your business credit

Understand the impact of Verizon’s reporting practices on your business credit profile help you manage this aspect of your business finance more efficaciously.

Positive payment history benefits

When Verizon business report positive payment history to business credit bureaus, it can help your business in several ways:

- Establish and build business credit separate from personal credit

- Improve business credit scores over time with consistent on time payments

- Create a positive track record with a major service provider

- Potentially qualify for better terms with other vendors and lenders

For new businesses peculiarly, having establish service providers report positive payment history can accelerate business credit building.

Negative reporting consequences

Conversely, negative reporting from Verizon business can create significant challenges:

- Decreased business credit scores

- Difficulty obtain credit from other vendors

- Potential higher interest rates on business loans

- Challenges with secure favorable terms for other business services

Unlike consumer credit, business credit reporting doesn’t require your permission, and the impact of negative items can be substantial and immediate.

Monitor your business credit reports

To stay informed about how your Verizon business account affect your credit, regular monitoring is essential.

Business credit report access

Unlike consumer credit reports, business credit reports aren’t available for free annual review. To monitor your business credit:

- Subscribe to business credit monitoring services through dun & Bradstreet, Experian business, or Equifax business

- Purchase individual reports as need to check for Verizon reporting

- Consider services that alert you to changes in your business credit profile

Some business credit card providers and banks nowadays offer business credit monitoring as a complementary service, which can be a cost-effective option.

Dispute inaccurate information

If you discover inaccurate information report by Verizon business on your credit reports, take these steps:

- Contact Verizon business direct through their business customer service

- Submit a formal dispute with the relevant business credit bureau

- Provide documentation support your claim

- Follow up regularly until the issue is resolved

Business credit disputes oftentimes take yearn to resolve than consumer disputes, so persistence is key.

Strategies for manage your Verizon business account

Implement effective management strategies for your Verizon business account can help ensure positive credit reporting.

Payment best practices

To maintain positive payment history with Verizon business:

- Set up automatic payments to avoid miss due dates

- Maintain sufficient funds in your payment account

- Consider pay a few days before the due date to account for processing time

- Keep detailed records of all payments make

- Review monthly statements readily for any billing errors

Many businesses find that dedicate a specific credit card or account for recur services like Verizon help with tracking and ensure timely payments.

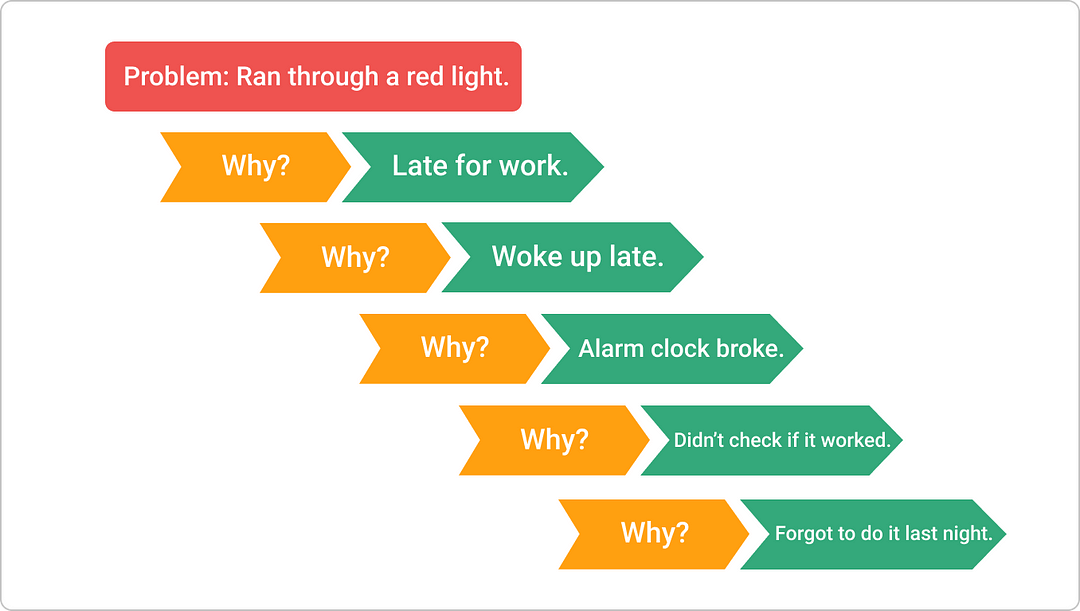

Communication during financial hardship

If your business experience financial difficulties that might affect your ability to pay:

- Contact Verizon business proactively before miss payments

- Ask about hardship programs or payment arrangements

- Get any agreements in writing, will include how the account status will be will report

- Follow through with any payment plans establish

Proactive communication frequently prevents negative credit reporting and preserve your business relationship with the service provider.

Understand business credit building with utility providers

Telecommunications and utility providers like Verizon business play a unique role in business credit building.

The value of utility payment history

Business credit bureaus value utility payment data because:

- Services are typically essential, make payment history a good indicator of business financial health

- Accounts normally involve regular monthly payments, show consistency

- These services oftentimes represent significant recurring expenses

- Utility providers tend to report more systematically than smaller vendors

For this reason, maintain positive standing with Verizon business and similar providers should be a priority in your credit building strategy.

Leverage positive history

Once you’ve established positive payment history witVerizonon business:

- Request a trade reference letter if you need for other credit applications

- Include your Verizon business account when list trade references

- Mention your positive payment history when negotiate with other service providers

- Use your establish business credit to request better terms or rates

Build business credit is cumulative, and each positive reporting relationship strengthen your overall profile.

Source: eiposgrado.edu.pe

Compare Verizon’s reporting practices to other telecom providers

Understand how Verizon business compare to other telecommunications providers help put their credit reporting practices in context.

Source: verizon.com

Industry standards

Among major telecommunications providers:

- AT&T business typically reports to similar business credit bureaus asVerizonn

- T mobile business has historically been less consistent with business credit reporting

- Comcast business and spectrum business loosely report significant delinquencies but may not report routine payment history

The telecommunications industry as a whole tends to report selectively, focus more on negative information than positive payment history.

Selecting providers base on credit reporting

If build business credit is a priority, consider:

- Ask potential providers direct about their credit reporting practices

- Request information in write about which bureaus they report to

- Check if they report positive payment history or simply delinquencies

- Will determine if they will provide trade references upon request

Some businesses strategically choose service providers base partially on their credit reporting practices to maximize business credit building opportunities.

Legal considerations in business credit reporting

The legal framework governs business credit reporting differ importantly from consumer credit regulations.

Business vs. Consumer credit reporting laws

Key differences include:

- The fair credit reporting act (fFCRA)mainly cover consumer credit reporting, with limited protections for business credit

- Businesses don’t have the same rights to free annual credit reports that consumers enjoy

- Dispute processes for business credit are typically determined by the credit bureaus quite than federal law

- Providers like Verizon business have more latitude in their reporting practices for business accounts

This less regulated environment make understand each provider’s specific practices yet more important.

Your rights as a business customer

Despite fewer legal protections, business customers however have certain rights:

- Accurate reporting of account information

- Access to your business credit reports (though typically for a fee )

- The ability to dispute inaccurate information

- The right to add statements to your business credit reports explain circumstances

Exercise these rights require vigilance and proactive management of your business credit profile.

Conclusion: manage your Verizon business account for optimal credit impact

Verizon business does report to credit bureaus — principally business credit bureaus like dun & Bradstreet, Experian business, and Equifax business. Their reporting tend to focus on significant delinquencies, though positive payment history may likewise be report.

For business owners, the key takeaways include:

- Maintain timely payments to avoid negative reporting

- Monitor your business credit reports regularly

- Understand the distinction between business and personal credit reporting

- Being aware of any personal guarantees that could affect your consumer credit

- Communicate proactively with Verizon business during any financial difficulties

By manage your Verizon business account responsibly and understand their reporting practices, you can protect and potentially strengthen your business credit profile while maintain essential telecommunications services for your company.

Remember that business credit building is a long term strategy, and consistent positive history with major service providers like Verizon business form an important foundation for your overall business credit health.

MORE FROM ittutoria.net