Health and Welfare Pay: Complete Guide to Benefits and Compensation

Understand health and welfare pay

Health and welfare pay represent a crucial component of employee compensation that extend beyond traditional salary or hourly wages. This form of compensation encompass various benefits design to support workers’ physical well-being, financial security, and overall quality of life. Unlike direct wages, health and welfare pay typically include employer contributions toward health insurance, retirement plans, disability coverage, and other essential benefits.

The concept of health and welfare pay has evolved importantly over decades, become an integral part of modern employment packages. Employers use these benefits to attract and retain talented workers while provide essential protections that might differently be unaffordable for individual employees. Understand how these benefits work can help you make informed decisions about job opportunities and maximize your total compensation value.

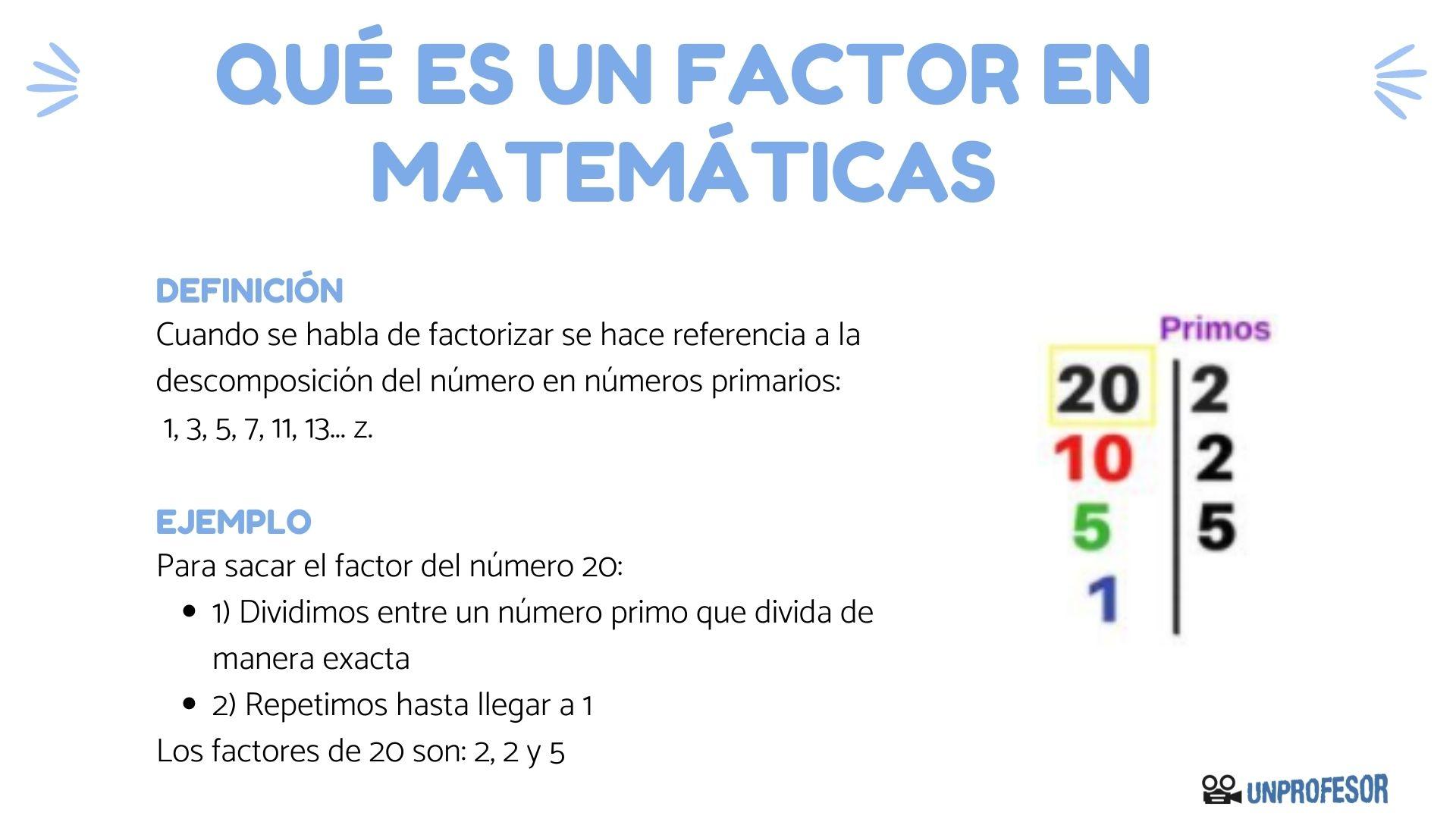

Components of health and welfare benefits

Health and welfare pay encompass numerous benefit categories, each serve specific purposes in support employee advantageously being. Medical insurance represent the well-nigh recognizable component, cover doctor visits, hospital stays, prescription medications, and preventive care. Employers typically contribute a significant portion of premium costs, make comprehensive healthcare coverage accessible to workers and their families.

Dental and vision insurance form additional layers of healthcare coverage, address specialized medical needs that general health insurance might not full cover. These benefits help employees maintain oral health and vision care without bear the full financial burden of routine cleanings, eye exams, or corrective procedures.

Life insurance benefits provide financial protection for employees’ families in case of unexpected death. Many employers offer basic life insurance coverage at no cost to employees, with options to purchase additional coverage at group rates. Disability insurance, both short term and long term, protect workers’ income when illness or injury prevent them from perform their job duties.

Retirement benefits, include employer sponsor 401(k) plans with match contributions, represent another significant component of health and welfare pay. These benefits help employees build long term financial security while potentially reduce current tax obligations through ppre-taxcontributions.

How health and welfare pay works

The mechanics of health and welfare pay involve complex arrangements between employers, insurance providers, and third party administrators. Employers typically negotiate group rates for various benefits, leverage their employee base to secure more favorable terms than individuals could obtain severally. This group purchasing power oft result in comprehensive coverage at lower per person costs.

Source: tffn.net

Premium sharing arrangements vary importantly between employers. Some organizations cover the full cost of basic benefits, while others require employee contributions through payroll deductions. The specific split between employer and employee contributions depend on company policies, union agreements, and competitive market factors.

Enrollment periods play a crucial role in health and welfare benefits administration. Most employers conduct annual open enrollment periods when employees can modify their benefit selections, add or remove dependents, or adjust coverage levels. Special qualifying events, such as marriage, divorce, or birth of a child, may allow mid-year changes to benefit elections.

Source: 213pension.org

Tax implications and considerations

Health and welfare pay carry significant tax advantages for both employers and employees. Employer contributions toward most health and welfare benefits are tax-deductible business expenses, while employees typically receive these benefits without immediate tax consequences. This tax favor treatment make health and welfare benefits specially valuable compare to equivalent cash compensation.

Notwithstanding, certain benefits may have taxable components. Life insurance coverage exceed $50,000 in value may result in imputed income for tax purposes. Likewise, some wellness programs or employer provide services might create taxable benefits that appear on employee pay stubs.

Pre-tax benefit deductions reduce employees’ taxable income, lower their overall tax burden. Contributions to health savings accounts ( (ahaso)flexible spending accounts ( fsa()SASo)h payroll deduction provide additional tax advantages, allow employees to pay for qualified medical expenses with pre tax pre-tax.

Calculate total compensation value

Understand the true value of health and welfare pay require look beyond the monthly premium contributions show on pay stubs. The actual value includes the difference between group rates and individual market prices, plus the tax savings frompre-taxx benefit deductions. This comprehensive view muchrevealsl that health and welfare benefits represent 20 30 % of total compensation value.

To calculate your health and welfare pay value, start by identify all employer contributions toward your benefits. This includes health insurance premiums, retirement plan matching, life insurance costs, and any other benefit relate expenses your employer cover. Add the tax savings from yourpre-taxx benefit deductions to determine your total benefit value.

Compare job offers require evaluate both salary and health and welfare benefits to understand total compensation packages. A position with lower base pay, but comprehensive benefits might provide greater overall value than a higher salary job with minimal benefit coverage.

Industry variations and standards

Health and welfare pay vary importantly across industries, company sizes, and geographic regions. Large corporations oftentimes provide more comprehensive benefit packages due to their ability to negotiate favorable group rates and absorb administrative costs. Technology companies oftentimes offer extensive health and wellness benefits as competitive differentiators in talent acquisition.

Union environments typically feature robust health and welfare benefits negotiate through collective bargaining agreements. These benefits oft include comprehensive medical coverage, generous retirement contributions, and additional protections like enhanced disability coverage or retiree health benefits.

Government employees broadly receive substantial health and welfare benefits, include pension plans and retiree health coverage that may not be available in private sector positions. These benefits much compensate for lower base salaries compare to equivalent private sector roles.

Maximize your health and welfare benefits

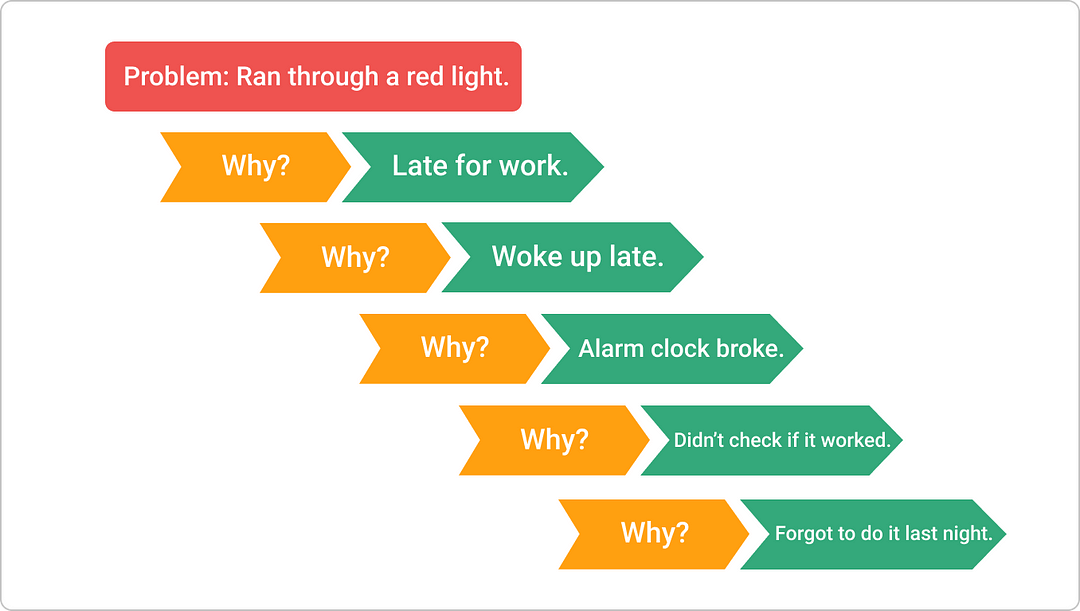

Strategic benefit utilization can importantly enhance the value you receive from health and welfare pay. Understand your plan details, include deductibles, copayments, and cover services, help you make informed healthcare decisions and avoid unexpected expenses.

Take advantage of preventive care benefits, which are typically covered at 100 % under most health plans. Regular checkups, screenings, and vaccinations help maintain your health while maximize your benefit value. Many plans besides offer wellness programs with financial incentives for healthy behaviors or biometric screenings.

Maximize employer retirement plan match by contribute astatine the least sufficiency to receive the full company match. Trepresentssent free money that importantly enhance your long term financial security. Consider increase contributions during salary increases or bonus periods to boost retirement savings without impact your take home pay.

Utilize flexible spending accounts or health savings account to pay for qualified medical expenses with pre-tax dollars. These accounts can cover deductibles, copayments, prescription costs, and many over the counter medical supplies, provide additional tax savings.

Future trends in health and welfare benefits

The landscape of health and welfare pay continue to evolve in response to change workforce needs and healthcare costs. Mental health benefits areceivedive increase attention, with many employers expand coverage for counseling, therapy, and mental wellness programs. This trreflectslect grow recognition of mental health’s impact on overall advantageously being and workplace productivity.

Telehealth services have become standard components of health benefit packages, offer convenient access to medical care while potentially reduce costs. These services specially benefit employees in rural areas or those with mobility limitations.

Personalized benefit platforms are emerged, allow employees to customize their health and welfare packages base on individual needs and life circumstances. These flexible approaches recognize that one size fit all benefit programs may not serve diverse workforce need efficaciously.

Financial wellness programs are expanded beyond traditional retirement planning to include student loan assistance, financial counseling, and emergency savings programs. These comprehensive approaches address the broader financial stressors that can impact employee advantageously being and productivity.

Make informed benefit decisions

Evaluate health and welfare pay options require careful consideration of your personal circumstances, family needs, and financial goals. Consider factors such as current health status, prescription medication needs, preferred healthcare providers, and anticipate medical expenses when select benefit options.

Review your benefit elections yearly during open enrollment periods, as your needs may change due to life events, health status changes, or family circumstances. Take advantage of decision support tools and resources provide by your employer or benefit administrators to make informed choices.

Understand the claims process and your rights under various benefit plans help ensure you receive the full value of your health and welfare pay. Keep detailed records of medical expenses, benefit communications, and claim submissions to resolve any issues that may arise.

Health and welfare pay represent a significant portion of your total compensation package, oft provide value that exceed the visible employer contributions. By understand these benefits, maximize their use, and make informed elections, you can enhance your financial security and overall advantageously being while get the most value from your employment relationship.

MORE FROM ittutoria.net